The SOV is created by the contractor and approved by the customer at the start of a project. Each item is assigned a price, resulting in the total contract value. The schedule of values (SOV) is a thorough list that supports the many project components.

An undercapitalized contractor may struggle to meet cash flow needs and may require additional long-term debt or an infusion of capital from the construction company’s owners. If the LOC is not paid off, it may suggest that the contractor is undercapitalized.

#Cashflow analysis for construction company full#

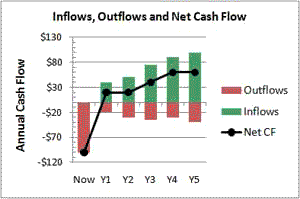

LOCs are short-term borrowing facilities that must typically be paid off in full at least once a year. The borrowed amount is calculated as a percentage of the contractor’s outstanding contract receivables. Many LOCs are accessible up to a certain limit based on a prescribed borrowing base calculation. To fund projects, many contractors will have to acquire and access a line of credit (LOC) with a financial institution. When construction companies utilize outdated tools to manage cash flow, these issues become more common. Mismanaging or failing to track change orders.Failure to fund an entire project as a result of late or non-payment.Failure to establish a payment schedule and/or an initial payment prior to starting work.Taking on several projects and exceeding cash capacity.If there isn’t enough positive cash flow, a project may suffer due to a lack of consistent funds.Ĭommon cash flow problems within construction are: Construction cash flow problemsĬash flow can be a major obstacle for the construction supply chain. Funds must be available in real-time to cover expenditures as needed. The key is to ensure that cash flows into the business fast enough to cover the construction supply chain while keeping costs low enough that cash is not tied up in one area of the business. When dealing with cash flow, construction firms should manage incoming funds to procure materials, pay salaries, complete projects, and support other day-to-day operations. This may be hard, but there are a few tactics that construction and contracting companies may use to get from being in the red to being in the black. Having a negative cash flow indicates that a firm may be facing financial problems, which, if not resolved, may lead to the company’s eventual demise. Those that have negative cash flows, on the other hand, do not have enough money coming in to meet their monthly obligations. This allows them to stay in the black and cover their bills on time each month. Companies with a positive cash flow have more money than liabilities. It is the amount of money and cash equivalents that flow into and out of a business at any one time. What Is Cash Flow?Ĭash flow is one of the most significant measurements in business. To estimate cash flow and manage construction projects profitably, you need quick access to key metrics and indicators before, during, and after a job. In the construction industry, maintaining consistent cash flow is crucial to the success of a project.

0 kommentar(er)

0 kommentar(er)